What is whole life insurance?

Contents

- Whole life insurance explained

- How does whole life insurance work?

- Types of whole life insurance

- Is whole life insurance worth it?

- Term vs whole life insurance: what’s the difference?

- Does whole life insurance have a cash value?

- How can I cash in a whole life policy?

- Uses of whole life insurance

- 3 limitations of whole life insurance

- Who should consider whole life insurance?

Whole life insurance explained

Sometimes known as ‘whole of life insurance’, a whole life policy provides insurance cover until the end of the insured person’s life, guaranteeing a payout to the beneficiaries whenever the insured dies.

How does whole life insurance work?

The purpose of all life insurance is to provide financial protection and security. Some types are taken out for particular reasons, such as making sure a mortgage is paid off or to provide for family members until they become financially independent. Whole life insurance provides permanent protection and peace of mind with no fixed end date.

An individual takes out a policy to insure their own life, or in some cases the life of another person. If that person dies, the policy pays out a lump sum to the person or people named in the policy as its beneficiaries.

The most important feature of whole life insurance is that it has no expiry date, so once it’s taken out then, as long as the premiums are paid, it remains in force until the time comes to claim the pay-out.

Types of whole life insurance

The main types of whole life insurance in the UK are:

Standard: the premiums don’t change and the payout (or death benefit) is fixed from the start.

Unit-linked: the funds in the policy are invested, meaning the eventual death benefit can vary, depending on how the investments perform.

With-profits: the policy pays occasional bonuses based on its investment performance.

Low-cost: premiums are kept down, usually by a gradual decrease in the death benefit as the insured gets older.

Flexible: the premiums and the final benefit can be changed during the life of the policy if the circumstances of the policy-holder change.

Reviewable: the insurer will look at the policy periodically to see whether anything needs to be changed because of factors like changes in life expectancy and the insurer’s own performance.

Is whole life insurance worth it?

Life insurance of any kind is worth considering because of the financial certainty it provides. Whole life policies can be more expensive than others but they also give the highest level of certainty. What you’ll pay depends on the amount of cover you want, but there’s nothing to prevent you from choosing lower cover with lower premiums. Ultimately, it’s for the individual to decide how much they can afford to pay for this important protection.

Term vs whole life insurance: what’s the difference?

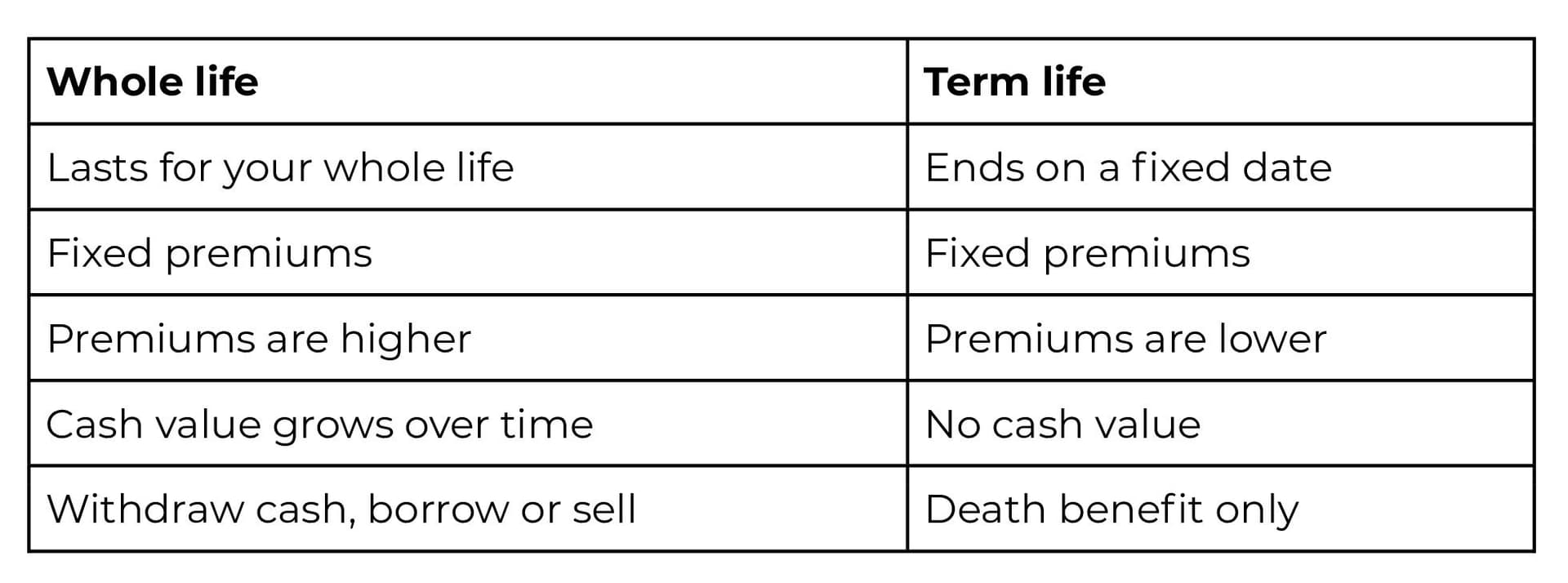

Both types provide a benefit on the death of the insured, but term life has a fixed end date, whereas whole life continues throughout the life of the insured. There are other important differences;

Whole life premiums are higher than term life premiums, but both are usually fixed, which makes for certainty in budgeting.

The upside of the higher premiums for whole life insurance is that the policy also works as an investment. The funds in a term life policy are released only when the insured dies but a whole life policy can be partially or wholly cashed in before then. Of course, if the entire fund is withdrawn and the policy closed there’s no longer any cover, which is a big decision, but the option is there.

Does whole life insurance have a cash value?

Unlike term life insurance, whole life policies usually build up a cash value. A proportion of the premiums paid are put into a savings plan and the policy-holder can borrow against the funds or even withdraw it. This investment aspect is one of the most attractive features of whole life insurance.

How can I cash in a whole life policy?

There are several options for taking cash out of your policy, although not all of them will be available under all policies.

Withdraw a cash amount

The value in the policy belongs to you which means you can take out any amount up to the total you’ve paid in premiums. Bear in mind that this will reduce the amount paid out to your beneficiaries upon your death.

Borrow money

Instead of taking the cash out, you could simply borrow from it. You can then either pay the money back when you can afford to or you can ask your insurer to reduce the eventual benefit by the amount you’ve borrowed.

Close the policy and take out the entire value

Doing this means there will be no payout when you die, but if you need access to money in an emergency this is a very useful option. Remember that there may be a fee for doing this.

Sell the policy

Your life insurance policy is a valuable asset so instead of cashing it in you might be able to sell it to a third party, who will take over payment of the premiums as an investment. Because it will then increase in value, you should be able to sell it for more than it’s worth at the time.

Uses of whole life insurance

Whole life policies can do more than pay out a benefit on the death of the insured. Here are some of the most popular alternative uses.

Inheritance tax and wealth transfer

For larger estates, when inheritance tax becomes an issue, whole life insurance can cover the tax liabilities that the heirs to the estate would otherwise have to pay. It also guarantees a specific sum to the beneficiaries of the policy which is usually tax-free.

Debts and funeral expenses

Rather than leaving those left behind to pay for the funeral and settle outstanding debts, a whole life insurance policy can cover all those costs.

Savings and loan collateral

Because most whole life policies include a savings element they can be used as a source of emergency funds and as security for loans.

Business uses

If a business or partnership depends on a member of its management team or key personnel, it could suffer if that person dies, in which case a whole life policy can provide the money to find a replacement or buy out their share of the business.

3 limitations of whole life insurance

1. Cost - Whole life policies are more expensive than alternatives like term life.

2. Return on investment - As an investment, whole life insurance tends to yield lower returns than investments such as stocks and shares

3. Long-term commitment - A whole life insurance policy is designed for the long haul and the policy-holder could lose out by ending the policy early. The longer the policy lasts the greater its value will be while the final payout is always known.

Who should consider whole life insurance?

Whole life insurance is a useful and versatile financial tool for people with particular aims.

Looking after children and dependants.

If you have family members or loved ones who rely on your income you might want to consider whole life insurance as a way of ensuring they will always be taken care of. If you’re no longer around they could still maintain their lifestyle, pay for university and even fund big financial decisions like putting down a deposit for a mortgage or tenancy.

Pursuing financial goals

If you’re interested in financial planning for things like investments, pensions and tax planning then whole life insurance can play an important part as a financial asset to be used as security as well as a resource from which you can borrow or withdraw cash.

Estate planning

If you’re concerned about leaving your family with tax burdens should you pass away, whole life insurance can be used to arrange your estate in such a way to limit the tax liabilities of inheritance, for example by using trusts which fall outside the reach of inheritance tax.

FAQs

It depends on several factors including the amount of cover you want as well as the age and health of the person insured. Industry research has given us some averages, ranging from £40.68 per month at the age of 30, through £62.43 at the age of 40 up to £106.28 at 50. However, these are averages. It’s perfectly possible to buy whole life insurance for as little as £9 a month.

You make monthly or annual payments called premiums which are usually collected by direct debit or continuing payment authority using stored card details.

A guaranteed lump sum payment to your beneficiaries when you do, access to the savings component of the policy should you need it while you’re living and a valuable asset which you can use as security for loans.

Yes, you can usually use a whole life policy as collateral for secured loans like mortgages.

Related resources

Turning Customer Curiosity Into Confidence: Theea's Coverage Calculator

Introducing Theea's Coverage Calculator: the intuitive insurance tool inspired by thousands of customer conversations that turns anxiety into tailored advice and confusion into confident choices.

Meet Your Newest Eleos Perks

We’re expanding our perks with two new additions designed to turn good intentions into healthy habits. Discover everything you can get for free with an Eleos policy.

Income protection for smokers

If you smoke, you may have a tough time getting income protection insurance, but it’s not impossible.

Do doctors need income protection?

A career as a doctor may be a vocation but you still have to earn a living

Do trade union members need income protection?

What financial support will your union give you if illness or injury forces you to stop working?

Getting Britain Working Again?

On 18th March 2025, the Secretary of State for Work and Pensions announced controversial disability benefit reforms