What is term life insurance?

Term life insurance explained

Term life insurance is a type of life insurance policy that provides cover for a specific period or term. If the insured person dies during the term of the policy, it pays out a death benefit to the people listed as the beneficiaries of the policy. If the insured person is alive at the end of the term, the cover ceases and there will be no pay-out.

Everyone’s needs and budgets are different so it’s impossible to put a figure on it, but a comparison of the UK’s biggest insurers gives a useful guide. This gives an average cost of for a level term policy taken out at the age of 30 with a payout of £300,000 at £9.40 a month.

The older you are when you take out a policy the higher the premiums will be but with most insurers you can buy term life insurance up to at least the age of 70 and often later.

6 types of Term life Insurance

If you’re looking into term life insurance you’ll find plenty of choice to suit different circumstances. These are the main ones:

Level term insurance

If you choose this option the amount that the policy will pay out if the insured dies is set at the start and remains the same throughout.

Decreasing term insurance

If you choose this option the final payout will decrease over time, which makes it cheaper than whole life. It’s particularly suitable to cover financial commitments like mortgages, where the amount to be repaid reduces over time.

Increasing term insurance

As the name suggests, this is the opposite of decreasing term. It’s designed to protect you from the effects of inflation, which is particularly useful if you choose a longer period of cover. Over 20 or 30 years the real value of the benefit is likely to be eroded, so increasing term insurance guards against this with regular reviews. The premiums are higher, but the eventual benefit is greater.

Annual Renewable Term Insurance

This type of policy provides the flexibility of short-term insurance, rather than committing to several years of cover. It renews each year and the premiums increase at each renewal. You have the option not to renew it if you no longer feel you need it.

Return of Premium Term Life Insurance

Term life policies have no cash value, which means you can’t withdraw any of the money you’ve paid in. However a ‘return of premium’ policy comes closest. If you outlive the policy term your insurer will give back the money you’ve paid in premiums when the policy ends. The refund feature means the premiums will be higher, but you’ll have the security of knowing your money will be paid out, one way or another.

Convertible Term life insurance

Some insurers will let you renew a term life policy or convert it to a whole life policy when it ends without the need for a medical examination.

What do you get with term life insurance?

The overarching benefit of any life insurance policy is peace of mind and the specific benefits of a term life policy include:

Financial protection: It gives the promise of financial security to your loved ones, knowing they will be provided for if you should pass away. Those who rely on your income could find themselves in financial straits without you if they’re not yet able to support themselves.

Repaying debts: If you die leaving unpaid debts then they’re likely to be repaid from your estate, which reduces the money your beneficiaries will receive. If one of those debts is an outstanding mortgage there’s a risk that your home will be repossessed. A term life policy could cover those debts, leaving your family and loved ones free of these consequences.

Education: If you have children that you’re sending to private school or putting them through university, the last thing you want is for their education to be disrupted because of money.A term life policy can help make sure they continue to get the education you intended.

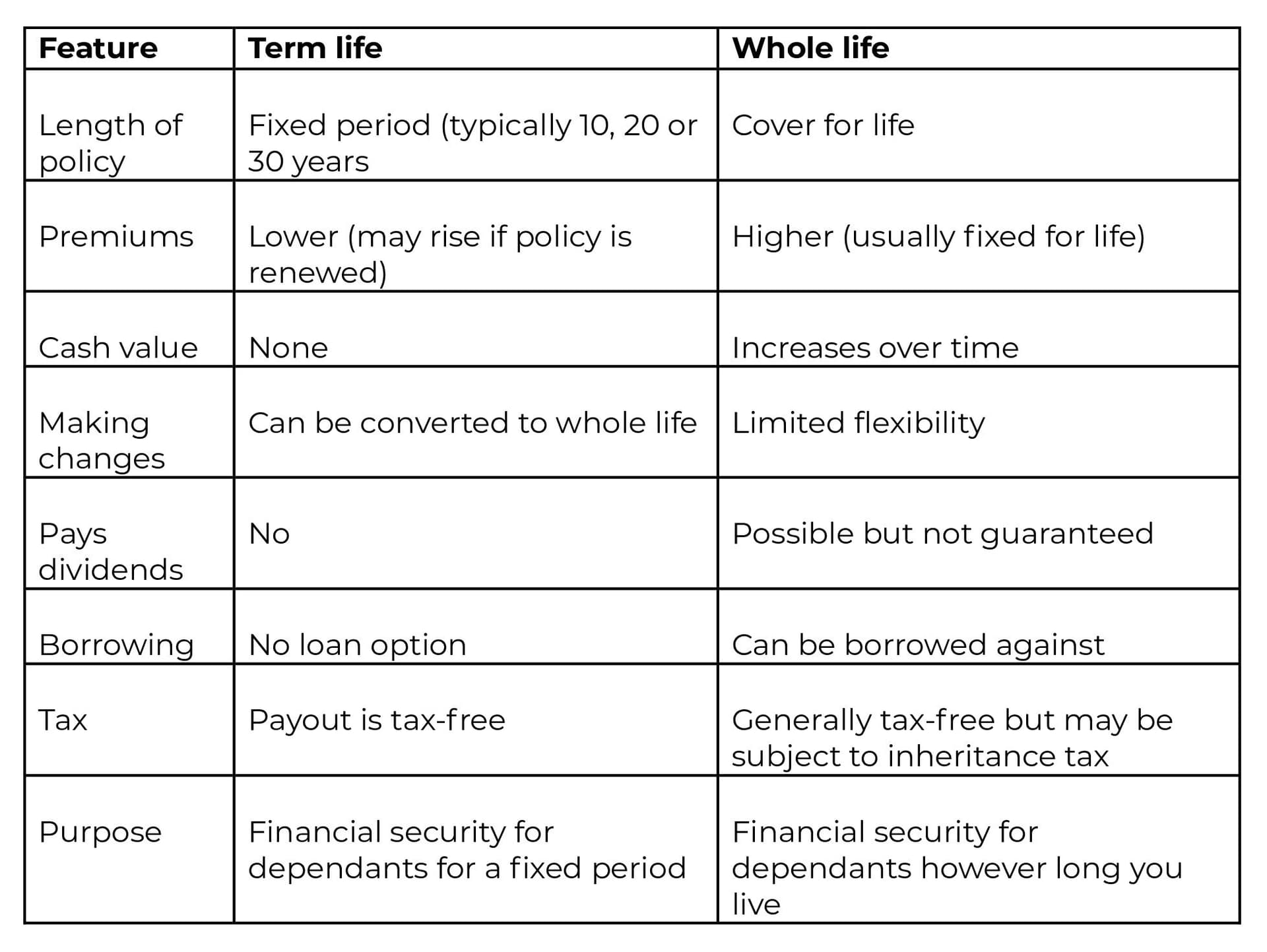

Term life insurance vs whole life insurance compared

Choosing a life insurance policy is a big decision and it’s important to understand your options. There are several major differences between term life and whole life insurance which the table below makes clear.

Advantages of term life insurance

There are several reasons to choose a term life insurance policy but the main ones are:

Affordability: Term life policies are cheaper than whole or permanent life insurance.

Flexibility: You can choose how long your cover will last, so your financial commitment is time-limited.

Drawbacks of term life insurance

No life insurance policy can offer all things to all people and while many features of term life insurance are positives for some, they might be disadvantages for others.

Fixed expiry date: A term life policy doesn’t last forever, which can make it attractive, but it won’t suit you if you’re looking for lifelong security.

No cash value: The money you pay into your term life policy only funds the payout if you die – you won’t have access to the cash for any other reason.

Who should consider term life insurance?

Term life insurance is a very useful form of financial protection for people in many kinds of situations. Here are some common examples.

Families with dependent children: Looking after a family is a serious responsibility and the financial safety net of a term life policy is ideal for both breadwinners and stay-at-home parents.

Homeowners with mortgages: Because mortgage loans needs to be repaid by an agreed date, the time-limited nature of term life insurance is a good match and it ensures your family won’t lose their home if you pass away.

Young professionals: If you’ve left education with student loans to repay or other debts, you can use a term life policy to make sure they won’t be passed to your family. The younger you are when you take out a policy, the cheaper it will be.

Business owners and partners: If a key employee or partner dies, the consequences for the business can be significant. A term life can help fund a replacement or a restructuring of the business. It can also be used to pay off business loans that would otherwise fall to your estate for repayment.

Carers: If you look after elderly parents or a child with special needs or a disability, a term life policy means they can still be looked after if anything happens to you.

Conclusion

You might have thought of term life as the poor relation of whole life. After all, why choose something that lasts for only a few years when you can have something for life? Now that we’ve looked at the question in detail, it’s clear that there are many advantages to term life insurance and many people for whom it’s the right choice. Informed decisions are always the best – now it’s up to you.

FAQs

No it doesn’t. Term life insurance is designed solely to provide a pay-out if the insured passes away, which makes it simpler and cheaper than a whole life policy.

If anyone depends on you for their financial security or you have debts, then it really doesn’t matter how young you are. Term life insurance can protect the people who look to you for financial support.

Mortgage repayments are one of the many financial commitments that can be met from a term life policy payout. It doesn’t have to be tied to one purpose so your beneficiaries can use the money as they need.

Most term life policies are taken out for between 10 and 30 years but it’s possible to find one that lasts for 40 or even 50 years. Some insurers will put an upper limit on this, but others will be flexible, as long as you take out the policy early enough for your chosen policy term not to exceed the upper age limit, which could be as old as 90.

Since a term life policy doesn’t build up any cash value you can’t borrow from it.

Related resources

Turning Customer Curiosity Into Confidence: Theea's Coverage Calculator

Introducing Theea's Coverage Calculator: the intuitive insurance tool inspired by thousands of customer conversations that turns anxiety into tailored advice and confusion into confident choices.

Meet Your Newest Eleos Perks

We’re expanding our perks with two new additions designed to turn good intentions into healthy habits. Discover everything you can get for free with an Eleos policy.

Income protection for smokers

If you smoke, you may have a tough time getting income protection insurance, but it’s not impossible.

Do doctors need income protection?

A career as a doctor may be a vocation but you still have to earn a living

Do trade union members need income protection?

What financial support will your union give you if illness or injury forces you to stop working?

Getting Britain Working Again?

On 18th March 2025, the Secretary of State for Work and Pensions announced controversial disability benefit reforms