Joint life vs single life insurance

What is single life insurance?

When we talk about life insurance, most of us are thinking about a single policy which insures the life of one person so that their family and dependants will be taken care of should they pass away. A single whole life insurance policy will last indefinitely, until the death of the insured, at which point the policy pays out. A single term life policy runs for a set period, typically 30 years or so. If the insured lives longer than this, the policy ends on its expiry date and there is no payout.

If you’re part of a couple, whether married, in a civil partnership or living together, you and your partner may well each have a single life insurance policy. If one of you should pass away, the survivor is still independently insured. But some couple choose to insure their lives jointly, so what are the advantages and disadvantages of joint life insurance vs single life insurance?

What is joint life insurance?

As the name implies, it’s a form of life insurance that insures two lives jointly and is available in both term and whole life versions. Couples make many joint financial arrangements – joint bank accounts and co-ownership of property, for example – because it can be more convenient. Joint life insurance is different in one important respect. A joint policy usually operates on what’s known as a ‘first death’ basis. This means that if one of the insured dies while the insurance is in place, the policy will pay out and end, leaving the survivor without life insurance.

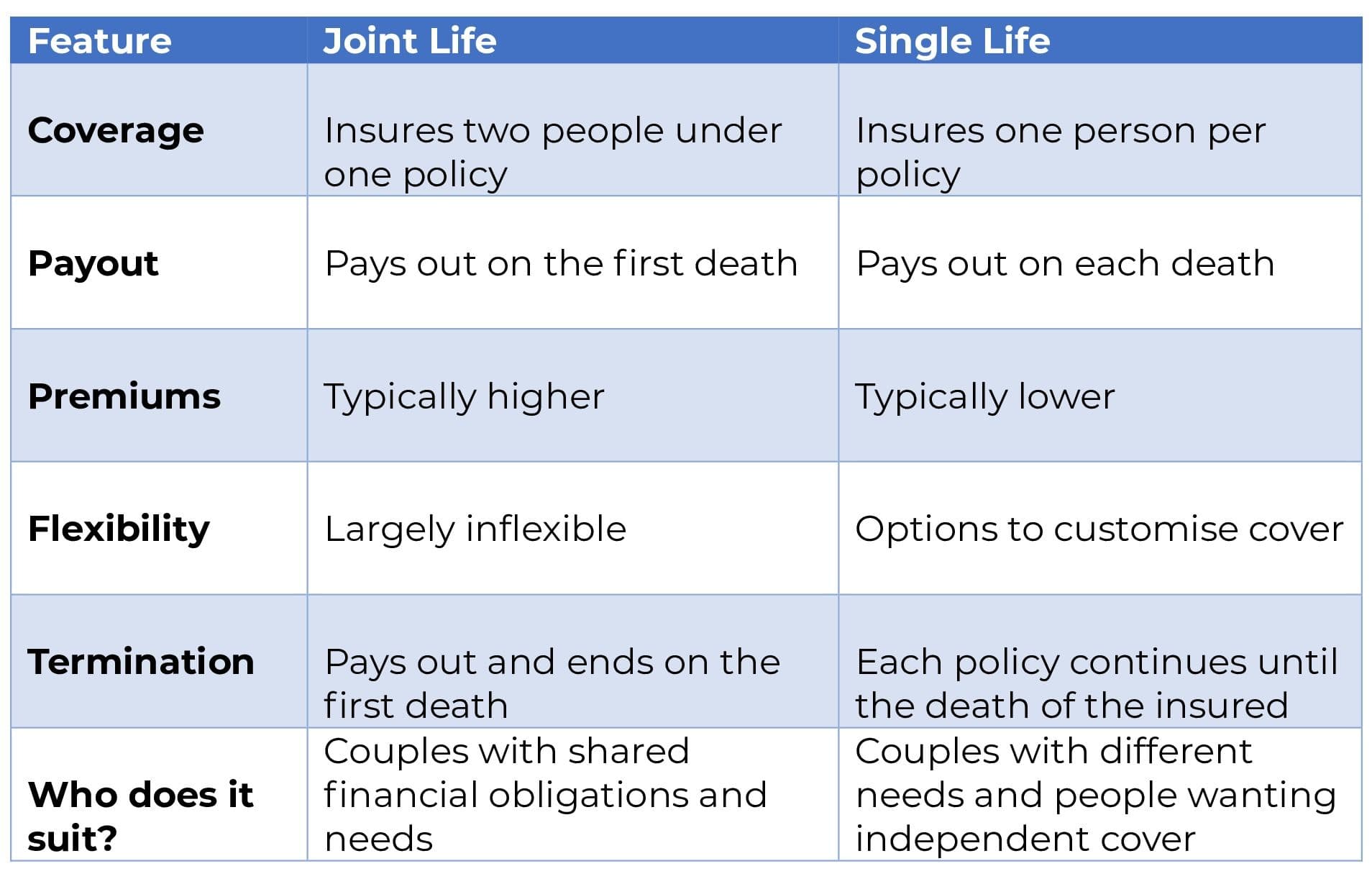

Joint and single life insurance compared

Similarities

Both joint and single policies are available as whole life and term life insurance, with the options of level, increasing or decreasing cover. You can find out more about these variations here and here.

Differences

There are two main differences. The first is that joint life insurance covers two lives in one policy, with a single monthly premium. The second lies in what happens on the death of the insured. Most joint policies pay out when the first person covered passes away, at which point the policy ends. The common practice is for the surviving partner to be the sole or main beneficiary of the policy and if they wish to, they can take out a new life insurance policy to cover themselves. This is the case whether the policy is term or whole life.

Pros and cons of joint vs single life insurance

Advantages of joint life policies

Convenience

Joint life insurance for married couples can keep things simple. One policy means there’s only one monthly premium to pay, and both partners are covered for the same amount. The option isn’t limited to those who are married and joint life insurance for unmarried couples may not be as common but it’s just as effective.

Cost

Joint policies tend to have lower premiums compared to two single policies.

Suitability

They’re particularly suited to couples with shared financial responsibilities such as mortgages, loans and looking after children.

Drawbacks of joint life policies

Payout

Most joint life policies pay out when the first person dies, which means the second person is no longer covered. In the US it’s become quite common to take out a policy that continues until the death of the second insured but these are still quite rare in the UK

Divorce

There can be difficulties in deciding how to deal with a joint life insurance policy after divorce. The main purposes for taking out the policy will probably no longer apply but it isn’t always easy to split the joint policy into two single ones. Some insurers offer a separation agreement option but many don’t and in any case there may be upper age limits on the facility.

Advantages of single life policies

Duration of cover

If one partner dies their own policy pays out and comes to an end, but the survivor is still covered.

Different levels of cover

Having single policies means that partners who may have different responsibilities can make separate arrangements. For example, one might have children from a previous relationship that he or she wishes to provide for without placing that obligation on their current partner

Income imbalance

If one partner is the major or sole breadwinner then the other partner will be more reliant on that larger income, whereas the higher earner will be less dependent on what the lower earner makes. This may mean the partners do not need identical cover. It also raises the question of whether to make provision for either partner being temporarily incapacitated and unable to work. Income protection can provide cover throughout their working lives, not only helping them to maintain their standard of living through illness but also ensuring they aren’t tempted to cut back on their spending by cancelling their life insurance.

Drawbacks of single life policies

Cost

The combined premium for two single policies is generally higher than the cost of one joint policy

Managing your cover

It may not seem there’s much to be done from day to day in terms of admin, but it’s important to keep life insurance cover under review and keep track of any notifications issued by the insurer. Having separate policies makes this a bigger task than for joint policyholders.

Life insurance for marrieds, unmarrieds and others

We’ve already talked about the suitability of joint life insurance for couple who are not married. In theory there’s no reason why even people who are friends shouldn’t choose a joint policy – especially if there is something that unites them financially, like joint home ownership. In reality it’s quite rare.

Related resources

Turning Customer Curiosity Into Confidence: Theea's Coverage Calculator

Introducing Theea's Coverage Calculator: the intuitive insurance tool inspired by thousands of customer conversations that turns anxiety into tailored advice and confusion into confident choices.

Meet Your Newest Eleos Perks

We’re expanding our perks with two new additions designed to turn good intentions into healthy habits. Discover everything you can get for free with an Eleos policy.

Income protection for smokers

If you smoke, you may have a tough time getting income protection insurance, but it’s not impossible.

Do doctors need income protection?

A career as a doctor may be a vocation but you still have to earn a living

Do trade union members need income protection?

What financial support will your union give you if illness or injury forces you to stop working?

Getting Britain Working Again?

On 18th March 2025, the Secretary of State for Work and Pensions announced controversial disability benefit reforms