Income protection vs savings

Why savings matter

People save for all kinds of reasons. To fund a deposit on the purchase of a home, to pay for a wedding or landmark celebration, to book the holiday of a lifetime, to buy the car of their dreams, to cover their children’s education, or just to build up enough of an emergency fund and savings to see them through difficult times. One of the main causes of income loss is an illness or injury that stops you from working.

Financial resilience

Aspirational saving, to pay for things you can’t buy from your regular salary, accounts for over 50% of people’s motivation to put money away, according to Statista. However, the biggest single reason cited by 63% of people in that survey was ‘for a rainy day’.

This is what’s known as financial resilience: the constant ability to withstand unexpected financial pressures. If you’re unable to work and have to take extended sick leave, your employer may not be generous with their sick pay. Their legal obligation is limited to Statutory Sick Pay of £118.75 per week and if you’re self-employed, Employment and Support Allowance will pay you no more than £92.05 per week. Savings seem to be the obvious answer, but it’s not the only one. Income protection insurance can be a very effective alternative. We’ll look at the relationship between savings and insurance later.

How to build savings

The American investor and philanthropist Warren Buffett famously said “Don't save what's left after spending, but spend what is left after saving”. That may be easy to say when you’re worth $143 billion but the principle is a sound one. Saving is better treated as a priority than an afterthought.

The 50/30/20 rule

The origin of this rule isn’t known but it was widely popularised by the US Senator and consumer protection advocate Elizabeth Warren in her 2005 book ‘All Your Worth’. It’s a rule that is endlessly quoted by banks and financial advisers. The idea is that, whatever your income, you should aim to spend 50% on needs and 30% on wants, with the remaining 20% going into your savings. We’ll come back to these percentages in a moment.

Maintaining your savings

It hardly needs saying that simply putting your savings under the actual or metaphorical mattress isn’t the best way of making your money work for you. Some people are tempted to put their savings into stocks and shares but at that point they cease to be savings and become investments, with all the elements of risk involved, even in the most secure investment vehicles. That goes for government bonds, blue chip companies and even ISAs because no investment is 100% secure.

With this reality in mind, most savers put their money into interest-bearing savings accounts. From January 2009 until August 2022 the Bank of England kept the base interest rate below 2% which meant for over 13 years savers saw minimal growth. It’s now 5% which means savings accounts are performing better.

Are your savings at risk?

If you go down this route you may ask ‘how can I protect my savings?’ The good news is that there’s a robust UK savings protection regime. If you use a savings account with a bank or building society you are covered by the financial protection for savings provided by the Financial Services Compensation Scheme (FSCS) which steps in if a financial institution collapses, as Northern Rock did in 2007. In such cases, FSCS compensates bank customers for up to £85,000 of their money.

Apart from the effects of bank failure, which are now limited by the FSCS safety net, there are other risks to your savings. One is an external pressure while the other is caused by your own circumstances.

Inflation

If your savings are in an account that doesn’t pay interest then their real value will gradually decrease as long as the inflation rate is above zero, which is (almost) always. Even an interest-bearing account isn’t guaranteed to match inflation, let alone outstrip it.

Depletion by use

The biggest blow to your savings is having to use them in an emergency. For many people this is precisely what their savings are for, but the inescapable fact is that you can only spend your savings once. If, for example, you have savings of £11,000, which is the UK average, and you take home the median average monthly salary of £2,000, how long would your savings last if you couldn’t work? Perhaps six months at the most. But even after three months your savings would be cut in half and you’d have to rebuild them.

How income protection supports both income and savings

This brings us back to income protection insurance. Savings and income protection are not mutually exclusive. Not only can they work together but income protection can actually protect your savings.

What is income protection?

It’s a form of insurance which gives you regular monthly payments to replace your lost income when you’re too sick to work. It covers both physical and mental illness and injury, paying as much as 70% of your pre-tax income, depending on the insurer and the policy. You can be covered for the whole of your working life and there is no limit to the number of times you can claim.

How it protects you

You take out income protection insurance when you’re fit and working. You work out the ideal amount you’d like to be paid, if you temporarily lose your income through sickness, and the ideal price you want to pay. If the cover and cost don’t match you can adjust them to find a workable compromise. The price you pay can be further reduced by choosing a longer waiting period (the time between stopping work and starting to be paid) and a shorter maximum benefit payment period (for example, 1 year instead of 2).

Once your policy is in place you’ll have the security of a constant source of income, which gives you financial resilience and freedom from worry about what you’d do if you couldn’t work.

How it supplements and protects your savings

An income protection policy makes it much less likely that you’d have to touch your savings and the amount you receive isn’t affected by how much you’ve put by (unlike Universal Credit). In this sense, an income protection insurance policy has a dual role as income protection and savings protection.

Income protection and savings compared

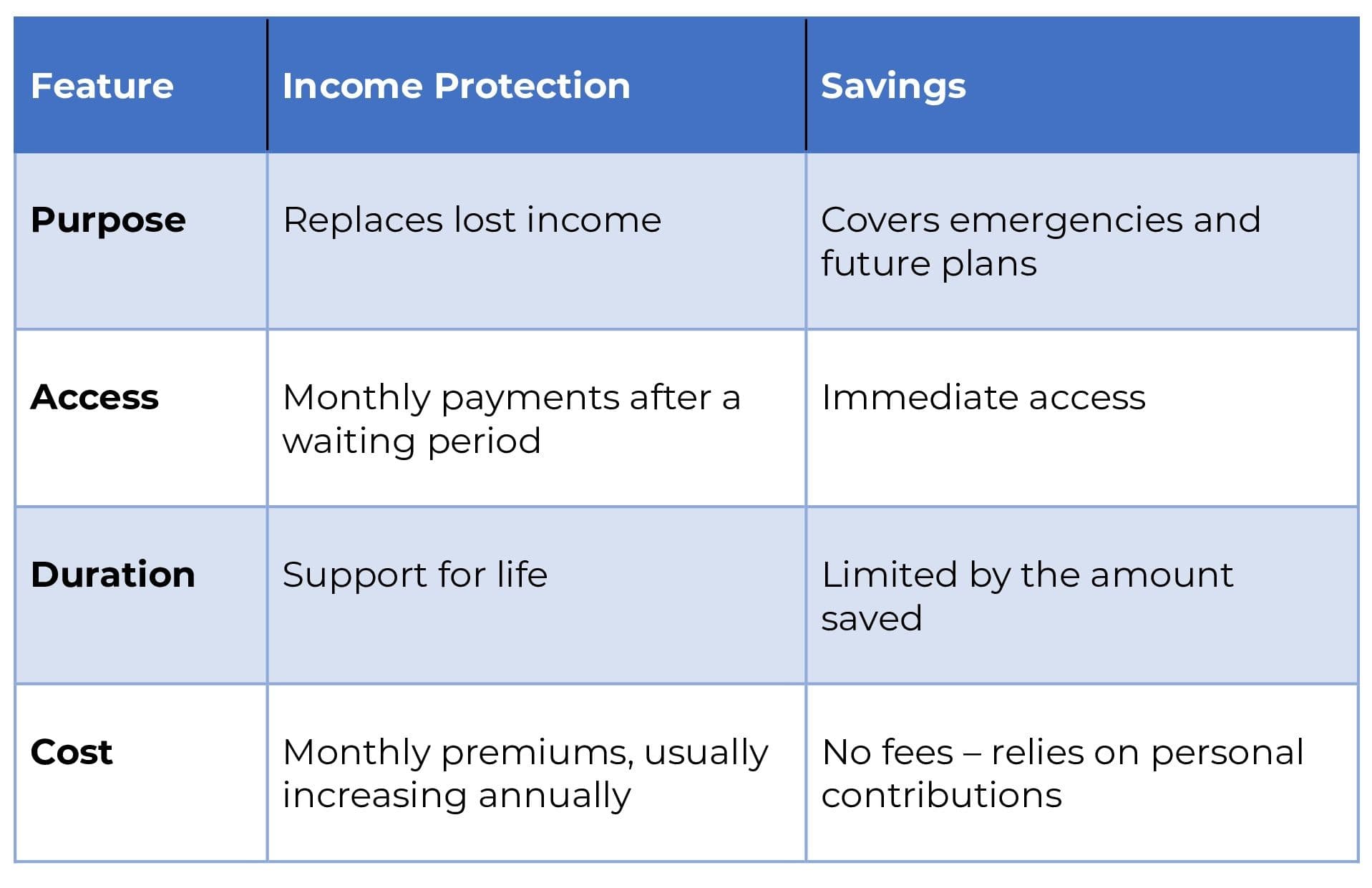

The main differences between income protection and savnigs at a glance:

Pros and cons of IP

For:

- Replaces your income whenever you’re too sick to work

- The number of claims you can make is unlimited

- Creates financial resilience and peace of mind

Against:

- Policy has no cash value so you can’t withdraw money you’ve paid in

- Benefit payments are not immediate, but made after a waiting period

- Pre-existing conditions and certain activities will not be covered

Pros and cons of Saving

For:

Immediate access to funds

The money is always in your possession

Against:

It can take a long time to build up significant savings

Savings are easily depleted in an emergency and must be replaced

Complementary protections

Income protection and savings work very well together, but if you struggle to build up savings then income protection can be a good alternative. We mentioned the 50/30/20 rule earlier and for some people, sparing 20% of their income will be a considerable stretch. In contrast, the cost of income protection insurance can be a much smaller fraction, which makes it a very affordable option.

There are also some other types of insurance which can complement the effectiveness of income protection:

Critical illness

This pays you a lump sum if you’re diagnosed with one of the serious illnesses specified in the policy. If poor health means you’re unlikely to work again it provides very valuable support

Redundancy insurance

Income protection only covers you for income lost through illness or injury. Redundancy insurance protects you against the financial consequences of job loss.

Mortgage payment insurance

If you own your home with a mortgage then the monthly repayment swill be one of your biggest expenses. If you can’t work you don’t want your home to be at risk and mortgage payment protection or mortgage life insurance can guard against this.

Life insurance

If your family depends on your earnings, income protection supports them as well as you. If you should pass away your income is gone for good, so life insurance is one of the best ways to make sure they’ll be looked after without you.

FAQs

No. Income protection insurance is not means-tested so the amount of savings you have won’t affect the cover you can get.

Possibly. For example, if you apply for Universal Credit you may be declined if you have savings of £16,000 or more.

No. Payments from an income protection policy are not subject to income tax. There may be an exception for group income protection policies, which are owned by your employer, who receives the benefit and then pays you through the company payroll. That could mean you do pay income tax, but on a personal policy you will not.

For as long as you keep paying your premiums your policy will cover you and you can claim as many times as you need. Sometimes a condition that stopped you from working recurs and it may be possible to treat this as a linked claim without a waiting period.

Yes, income protection is available to anyone who work and earns, whether employed or self-employed. The calculation of a self-employed income is more complicated than for an employee since you won’t have payslips, but income protection is very popular amongst self-employed people, for whom there is very little help from elsewhere.

Related resources

Turning Customer Curiosity Into Confidence: Theea's Coverage Calculator

Introducing Theea's Coverage Calculator: the intuitive insurance tool inspired by thousands of customer conversations that turns anxiety into tailored advice and confusion into confident choices.

Meet Your Newest Eleos Perks

We’re expanding our perks with two new additions designed to turn good intentions into healthy habits. Discover everything you can get for free with an Eleos policy.

Income protection for smokers

If you smoke, you may have a tough time getting income protection insurance, but it’s not impossible.

Do doctors need income protection?

A career as a doctor may be a vocation but you still have to earn a living

Do trade union members need income protection?

What financial support will your union give you if illness or injury forces you to stop working?

Getting Britain Working Again?

On 18th March 2025, the Secretary of State for Work and Pensions announced controversial disability benefit reforms