Income protection for teachers

Why do teachers need income protection insurance?

There are more than 640,000 full-time teachers in the UK. If you’re not in the profession, it can seem that teachers have it pretty good. Once they’re qualified, they’ll earn more than the national average and get thirteen weeks off in the school holidays. And as public servants they probably get generous sick leave, don’t they?

If you’re a teacher you’ll know this isn’t the whole truth. Sick pay for teachers is far from straightforward.

Firstly, there’s a pay scale with over 40 grades based on experience and responsibilities. The profession is divided into heads, lead practitioners, qualified teachers, unqualified teachers and teaching assistants. For supply teachers, there are separate arrangements.

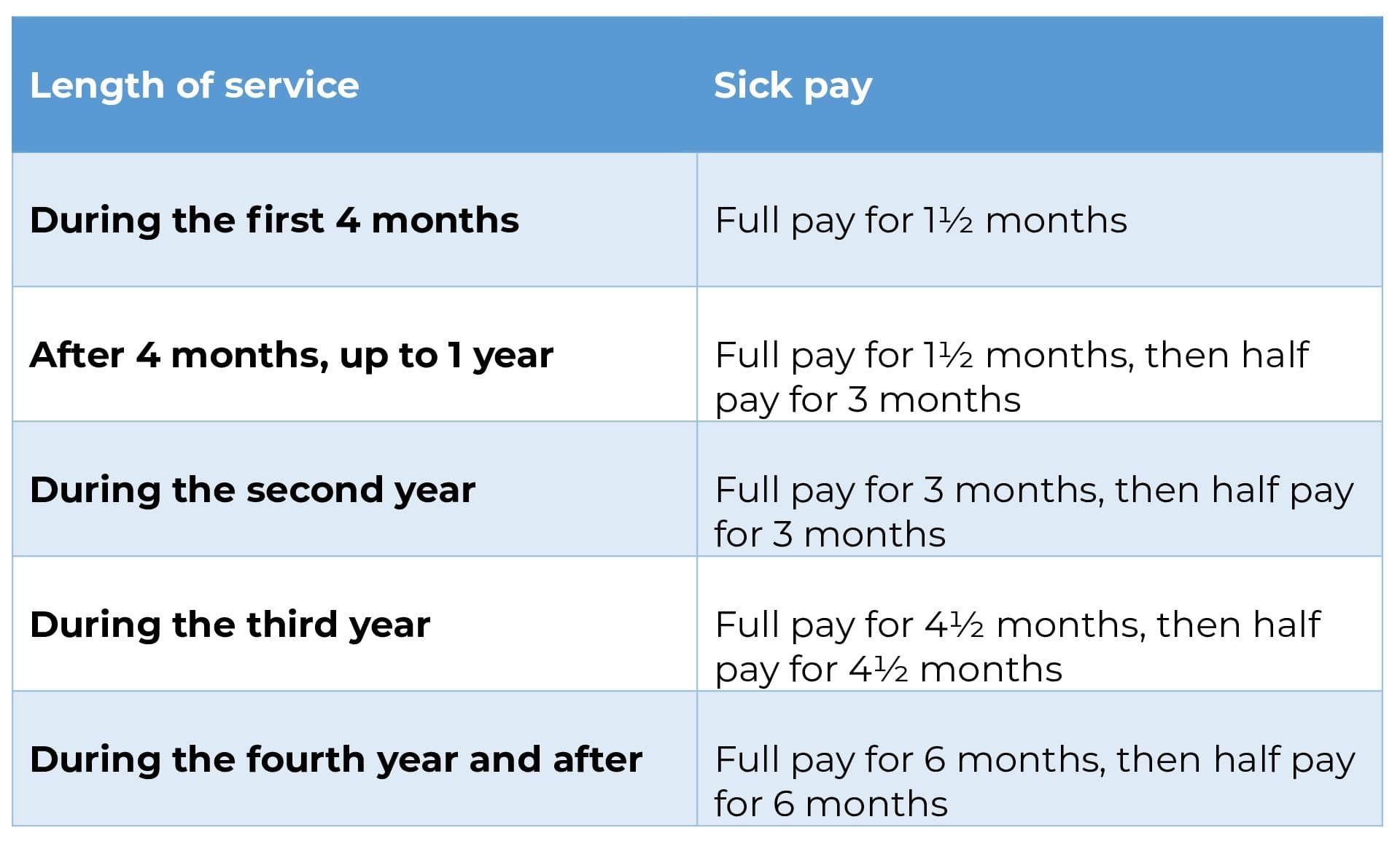

Secondly, teachers’ sick pay entitlements are complex, based on salary and length of service. Most local authorities follow the terms of the Burgundy Book which form part of their teachers’ employment contracts.

For how long do teachers get sick pay?

Other financial support

If you get injured or fall ill and have to take long-term sick leave, the support you can count on as an employee is limited. So where else can you turn?

Statutory sick pay for teachers

This lasts for 28 weeks, which means it can be paid to teachers in their first and second years of service after their employee sick pay comes to an end. However, it’s currently just £118.75 a week, so it falls far short of replacing their lost income.

Teachers’ unions

If you’re a member of a union you may find that your membership includes an element of teachers’ income protection insurance which pays you something while you’re unable to work, although this is likely to be fairly minimal.

Occupational risks for teachers

In addition to the kind of health problems that can affect anyone, you face risks that are specific to your job. Teaching might not be everyone’s idea of a dangerous profession but the demands of the work, both physical and mental, can take their toll.

Physical fatigue

Maintaining control of a class of 30 children is a very physical job. Add to that the hours you spend on your feet, carrying out physical tasks and fulfilling extra responsibilities like playground duty and after-school clubs and the musculoskeletal strains and other physical exertions of the job become clear.

Mental stress

Dealing with heavy workloads, preparing lessons, setting and marking homework, together with the emotional pressures of managing and supporting students, can cause stress, anxiety and burnout.

Income protection for teachers

Given the complexity of your sick pay entitlements and the inherent risks of your job, you may find that taking out a personal income protection insurance policy gives you more realistic financial support in times of sickness.

How it works

You can find a more detailed explanation of Eleos IP here, but these are the essentials:

- You take out a policy while you’re fit and working.

- You decide how much you’d like to be paid if you’re ever unable to work due to illness or injury.

- You can adjust certain features of the policy to get the cover you want at a price you can afford.

- If you have to take sick leave you can make a claim and, once it’s approved, you’ll receive regular monthly payments until you’re able to return to work, up to a maximum of 1 year or 2, depending on the period you’ve chosen.

Things to consider when applying

You need to be working when you apply, full-time or part-time. Other issues that will be relevant to your application include your age, health and lifestyle

Health

You’ll be asked about your current state of health, as well as any major issues in the past, and your family medical history will also be looked at. You’ll need to disclose any pre-existing medical conditions, which are illnesses, injuries or health problems you have at the time you apply for the policy. The information you give is primarily to help assess the risk of insuring you, not as a reason to turn you down, although it’s possible that any pre-existing condition may be excluded from cover.

Lifestyle

Teaching isn’t classed as one of the dangerous occupations that most insurers exclude from their income protection policies. However, there may be some non-medical risks that would increase your chances of illness or injury, so claims arising from these may be excluded. There’s more information about this here, but examples include extreme sports, drug or alcohol misuse and self-inflicted harm.

Definition of your job

Income protection generally covers three levels of inability to work.

Own occupation – covers you if you’re unable to do your normal job

Suited occupation – covers you if you’re unable to any job appropriate to your skills and experience

Any occupation – covers you if you’re unable to do any job

Own occupation is most people’s preferred option, although the premiums tend to be higher than for the two wider definitions.

What does income protection cover?

Income protection insurance doesn’t focus on specific illnesses or injuries. Its purpose is to insure you against losing your income through illness or injury. The nature of the condition is not what matters, it’s your inability to work. To satisfy that requirement you’ll need to show proof from a healthcare professional that you’re unable to work as a result of the condition.

Income protection applies to mental as well as physical health. So, provided you have supporting evidence, a claim arising from anxiety or depression can be just as valid as one for a broken leg or pneumonia.

What does it cost?

You pay for your policy with monthly premiums which are calculated according to the information you give when you apply. It’s impossible to put a figure on it since everyone’s circumstances are different, but it can cost as little as a few pounds a month. There are adjustments you can make to some of the policy terms which will also have an upward or downward impact on the price.

Special features

Income protection policies aren’t all the same. These are just a few of the special features you may want to look out for when making your choice.

Career break

Some insurers, like Eleos, will allow you to pause your policy if you temporarily don’t need it, such as if you’re on sabbatical. This is known as a career break and both your cover and your premiums will be put on hold for an agreed period.

Free extras

Some insurers include free extras when you take out a policy, such as discounted gym membership or healthcare support. Eleos provides a 24/7 remote GP service and a cashback offer that gives you money back every time you spend with a long list of popular brands.

Length of claim

You’ll find policies that will pay you if your illness or injury incapacitates you for up to 5 years while most will cover you for 1 or 2 years. 5 year cover sounds very appealing but naturally the cost will be higher. Eleos focuses on 1 and 2 year cover.

Waiting period

Before you take out an income protection policy, check the sickness benefits that your job entitles you to receive. For teachers that will depend on your length of service. When you take out a policy you’re asked to select a waiting period, which is the time you’re happy to wait between stopping work and receiving your first payment. A longer waiting period means lower premiums, so it’s a good idea to time your waiting period to end at the point when your employee sick pay finishes. Your insurance can then take over.

Alternatives to income protection for teachers

If you decide not to take out income protection, or you want additional cover, there are a number of options.

Critical illness

This pays out a lump sum if you’re diagnosed with one of the severe illnesses specified in the policy. There’s no definitive list but conditions include cancer, multiple sclerosis and stroke. It can work well with income protection to give you extra cover and greater financial security.

Accident only

This is a frequent choice for people who are unable to get income protection because their current state of health makes them uninsurable. It won’t cover you for illness, but if you’re injured in an accident – workplace or otherwise – it will support you until you recover. It’s simpler than IP because it doesn’t require any medical underwriting (i.e. assessment of your health)

Group income protection insurance

Group schemes are common in private companies but rarer in state education. However, you should check whether your teaching institution has a scheme in place, because, although the cover is likely to be more basic, it gives you some security and the premiums may be paid by your employer.

Life insurance

It won’t support you, since it pays out only when you pass away, but life insurance is a good way of providing for your family if they’re likely to struggle without your income.

Savings

Of course, you may decide you don’t want to rely on insurance at all and simply save up an emergency fund. It’s a perfectly legitimate choice, but bear in mind that you can only spend your savings once, whereas IP insurance pays out every time you make an approved claim, with no limit on the number of claims you can make. Not only does it support you when you can’t work, it protects your savings.

FAQs

Teachers on contract continue to be paid throughout the holidays, so being too sick to work isn’t an issue at those times. However, if you get ill or injured during a school holiday and you’re not able to return to work at the start of the new term, income protection can pay you until you are.

Yes, if teaching assistants are employed under contract by the school or local authority, they are eligible for income protection insurance. Some insurers stipulate that you must work for at least 16 hours a week in order to qualify.

Yes, but it follows different rules, set out in the Green Book for support staff, which takes a rolling average of a TA’s 12-month attendance record and will deduct previous absences in that period from their sick pay entitlement

Supply teachers often fall into a different category, since they are not employees, but freelancers. They’re perfectly entitled to take out IP – the main difference is in how an insurer will assess their income. They usually calculate it as an average over 2 or 3 years.

Since they’re not employed by the schools where they teach, they’re unlikely to be entitled to teacher’s sick pay or statutory sick pay. As freelancers they may be able to claim Employment and Support Allowance, a state benefit currently worth £90.50 a week. Some supply teachers have a contract with a local authority or with an employment agency, which might include provisions for sick pay.

Related resources

Turning Customer Curiosity Into Confidence: Theea's Coverage Calculator

Introducing Theea's Coverage Calculator: the intuitive insurance tool inspired by thousands of customer conversations that turns anxiety into tailored advice and confusion into confident choices.

Meet Your Newest Eleos Perks

We’re expanding our perks with two new additions designed to turn good intentions into healthy habits. Discover everything you can get for free with an Eleos policy.

Income protection for smokers

If you smoke, you may have a tough time getting income protection insurance, but it’s not impossible.

Do doctors need income protection?

A career as a doctor may be a vocation but you still have to earn a living

Do trade union members need income protection?

What financial support will your union give you if illness or injury forces you to stop working?

Getting Britain Working Again?

On 18th March 2025, the Secretary of State for Work and Pensions announced controversial disability benefit reforms