Income Protection vs Critical Illness Insurance

Contents

- What is income protection insurance?

- Critical illness cover vs income protection: what are the similarities?

- Critical illness cover vs income protection: what are the differences?

- Critical illness or income protection - which one is best?

- What does critical illness insurance cover?

- Combining income protection and critical illness

- Conclusion

What is income protection insurance?

Income protection insurance creates financial security by replacing a proportion of your income if you’re unable to work through illness or injury. It enables you to meet your living expenses and maintain your standard of living while you focus on recovery. It’s a versatile option for all kinds of people, from individuals and couples to family breadwinners and the self-employed.

Income protection and critical illness insurance are designed for two distinct purposes. Both are intended to help you with the financial impact of being unable to work because of health conditions but the situations in which you can make a claim and the way in which your benefit is paid out are different.

Critical illness cover vs income protection: what are the similarities?

Their purposes are different, but critical illness and income protection policies have several features in common.

Purpose: Both types give you financial support when you’re unable to work because of poor health.

Tax: If you pay the premiums for your own critical illness and income protection insurance, you won’t have to pay tax on the benefit you receive.

Premiums: What you pay for your policy is influenced by your age, health, lifestyle, and the level of cover you want. This is part of what’s called ‘underwriting’.

Exclusions: Neither will cover you for specific things like pre-existing health conditions and certain kinds of activity.

Information: When you apply and also when you claim, you need to give complete and accurate information about your health and lifestyle.

Customisable: Policies are flexible enough for you to tailor them to your individual circumstances.

Peace of mind: Both types give you not only financial security but also peace of mind.

Claiming: To receive the benefit you need to go through a claims process, which will include giving evidence of your health condition, such as confirmation from a qualified medical professional.

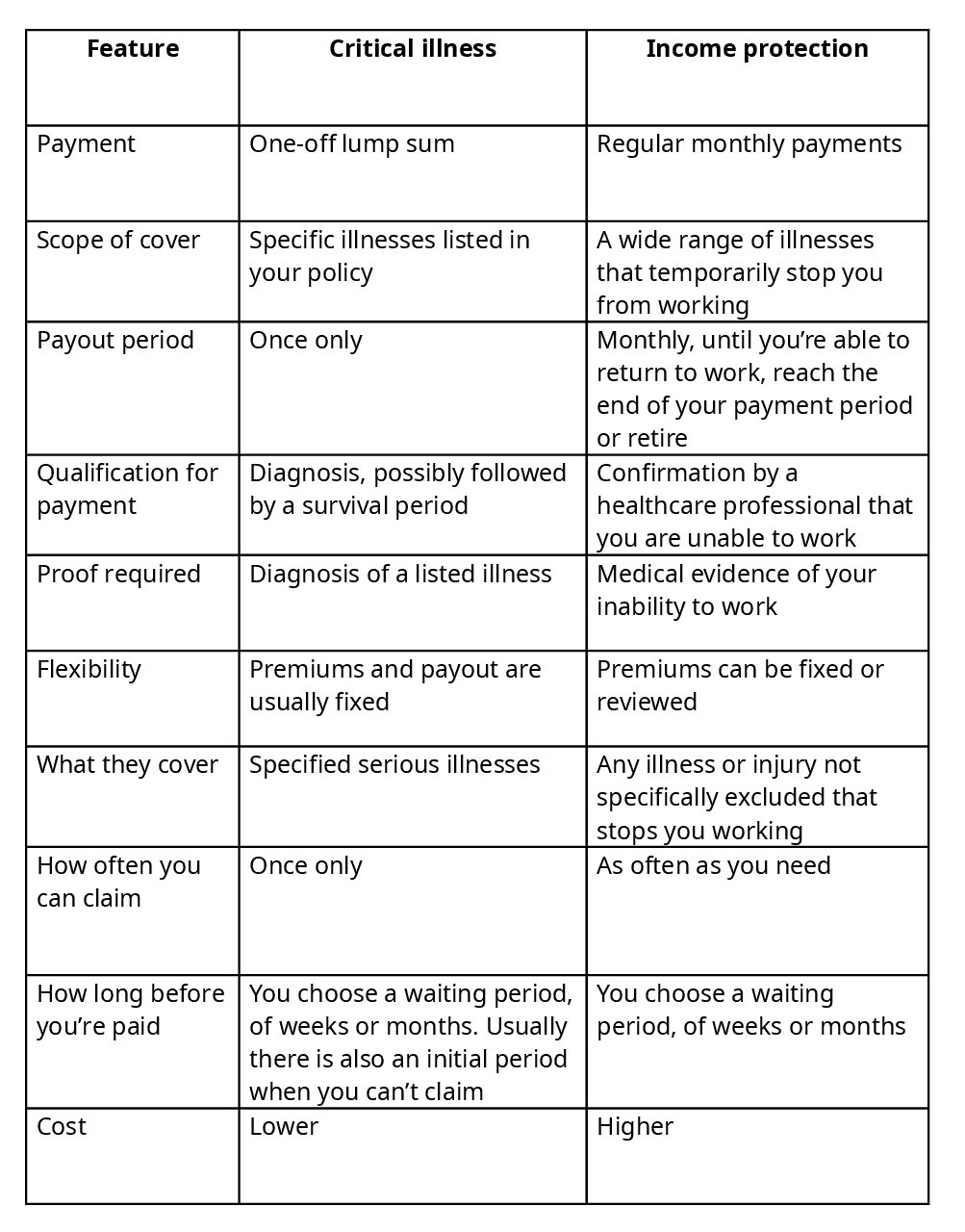

Critical illness cover vs income protection: what are the differences?

Despite the similarities, there are several areas in which the two types of insurance differ.

Critical illness or income protection - which one is best?

Since the two types of insurance solve distinctly different problems, the question of which is best isn’t really possible to answer in binary terms. Rather the question should be, ‘which one suits you best?’

Income protection insurance could be a good choice if:

Your main concern is how you’d manage should illness or injury temporarily stop you from working

You’d like regular monthly payments to replace a proportion of your income

You want to be able to claim whenever it happens during your working life

Critical illness insurance may be a good fit if:

You worry that a serious illness could permanently stop you from working

A lump sum payment would give you the flexibility to cover your expenses and look after your family.

If you want to be covered for both eventualities then there’s no reason not to take out both types of insurance. Obviously, the cost of two policies is considerably more than one, so you’d want to balance the range and level of your cover with what you can afford.

What does critical illness insurance cover?

Critical illness insurance covers the kind of serious medical problems that can be described as life-changing or life-limiting. Coverage differs under different policies, but the core conditions include cancer, heart disease, strokes and major organ transplants.

Combining income protection and critical illness

Together, critical illness and income protection insurance give you comprehensive financial protection for illnesses and injuries that can have a serious impact on your ability to earn. While income protection gives you short-term support until you’re able to go back to work, critical illness is there to provide a safety net if an illness means you’re unlikely to be able to work again.

They are separate policies which you can take out independently of each other with different insurers, but most companies that offer one will offer both, so you may feel it’s easier to take out two policies with one insurer. The choice is entirely up to you.

Conclusion

Illness and injury are among the most frequent causes of lost income. There is some financial support available, both from employers, who are legally obliged to provide statutory sick pay, and from the government in the form of benefits for the self-employed and in some cases of disability. However, the amounts you’re entitled from any of these sources may fall short of what you really need to maintain your lifestyle or even makes ends meet. Critical illness and income protection insurance enable you to make financial arrangements that genuinely answer your needs and give you the security and peace of mind that comes with knowing you and your dependants are prepared for the monetary consequences of both short-term and long-term inability to work.

FAQs

You can take out critical illness insurance as a standalone policy or combine it with a life insurance policy. It’s entirely up to you, although combining them sometimes gives better value and broader coverage.

Premiums are based on factors like your age, health, lifestyle, occupation, the level of cover you ask for and the number of illnesses covered. If you’re a non-smoker and in generally good health your premiums will probably be lower.

Some policies will let you make changes if there is a change in your circumstances such as getting married or having children.

Your family history may be a factor in an insurer’s calculation of your premiums or in setting the terms of your policy, but it won’t necessarily mean you can’t get cover.

You can cancel your policy at any time. If you decide to do this, bear in mind that you’ll no longer be covered if you fall seriously ill and your premiums won’t be refunded.

Related resources

Turning Customer Curiosity Into Confidence: Theea's Coverage Calculator

Introducing Theea's Coverage Calculator: the intuitive insurance tool inspired by thousands of customer conversations that turns anxiety into tailored advice and confusion into confident choices.

Meet Your Newest Eleos Perks

We’re expanding our perks with two new additions designed to turn good intentions into healthy habits. Discover everything you can get for free with an Eleos policy.

Income protection for smokers

If you smoke, you may have a tough time getting income protection insurance, but it’s not impossible.

Do doctors need income protection?

A career as a doctor may be a vocation but you still have to earn a living

Do trade union members need income protection?

What financial support will your union give you if illness or injury forces you to stop working?

Getting Britain Working Again?

On 18th March 2025, the Secretary of State for Work and Pensions announced controversial disability benefit reforms