Age-based premiums vs level premiums

Life insurance and long-term protection

From a simple idea, life insurance has evolved into a network of complementary and alternative options for financial protection. This can cause a lot of confusion when you’re trying to settle on the right one for your situation. It may be helpful to establish one of the fundamental distinctions between the different types.

Life insurance is a way of providing for your family and dependants after you’ve passed away. In most case, but not all, it’s a long-term plan to guarantee their financial security far into the future. But what does long-term mean?

Essentially, life insurance policies take two forms: whole life and term life. A whole life policy is open-ended, lasting until the death of the insured. A term life policy lasts for a fixed period (usually up to 30 or 40 years) and pays out if the insured dies within that period. When the policy reaches its expiry date the cover it provides ends.

Age-based and level life insurance

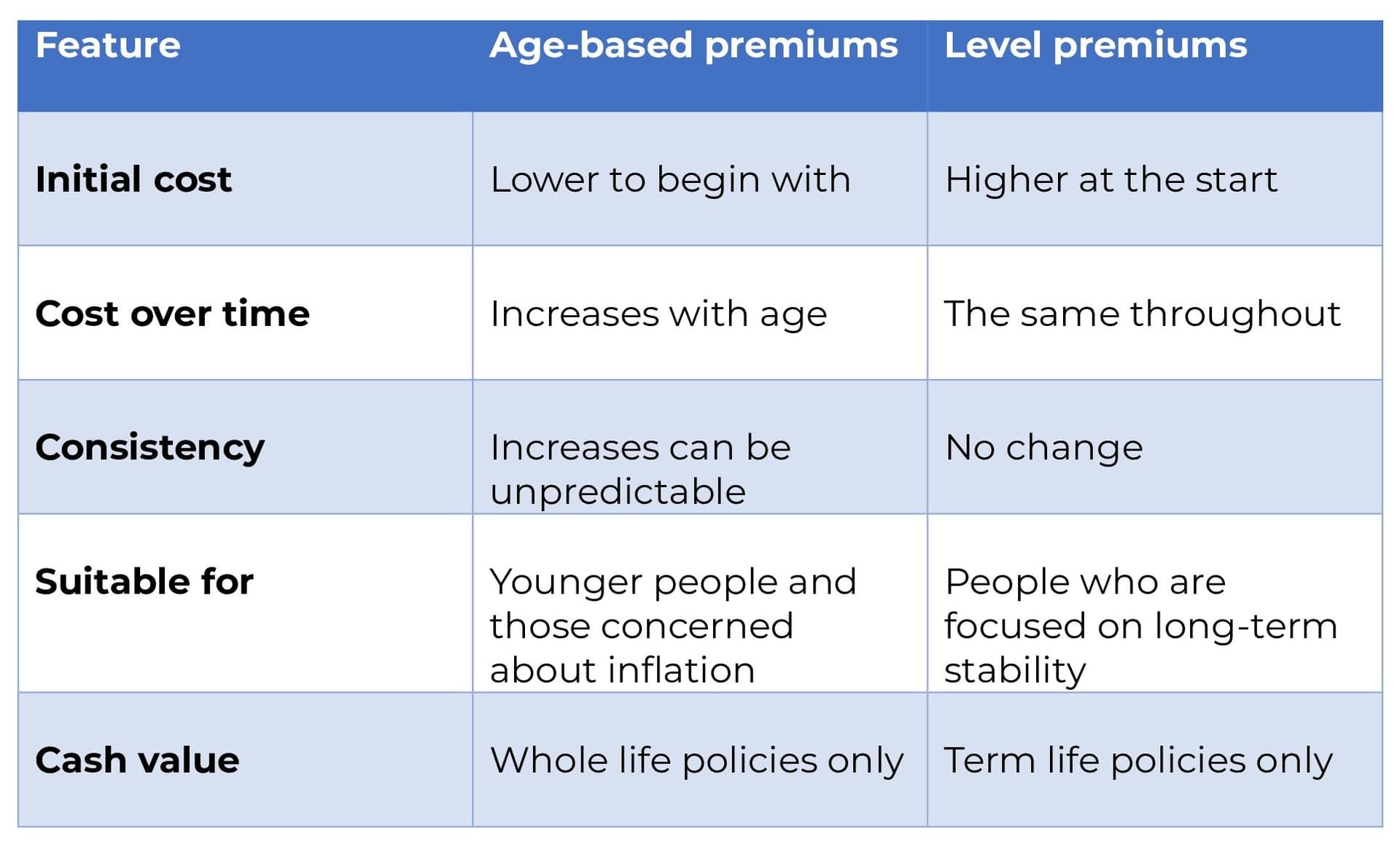

Two very popular choices of life insurance are age-based and level variants. Age-based ones tend to be whole life policies, while level ones are more likely to be term life policies. However, they are not mutually exclusive and it’s possible to have whole life and term life insurance in either form.

Aged-based policies

An age-based policy is one in which the premiums increase, usually each year, as the insured gets older. Factors that will affect your life insurance premium include your age, your health, your family medical history and your occupation. The final payout – the sum assured – increases in step with the premiums.

Level policies

A level policy is one in which the premiums remain the same throughout the policy, irrespective of the age of the insured. The sum assured is set at the start of the policy and remains the same throughout.

How do age-based premiums work?

The premiums for age-based policies usually start off relatively low because insurers assess the level of risk over many years and calculate the compound revenue they’ll receive in the long term. They can afford to offer a low starting rate because the initial level of cover is also quite low. As the sum assured grows, your insurer will increase your life insurance premiums by age.

What is the rate of increase?

Each insurer will make its own judgements on the appropriate size of the annual increase but as a rough guide, it’s fairly common for age-based premiums to increase by around 5% each year. The payout grows by a similar amount.

What are reviewable premiums?

An age-based premium can either be subject to a consistent percentage increase each year, or it can be reviewable. This means rather than just applying the automatic increase, the insurer can review the policy by looking not just at the age of the insured but also their state of health at the time of the review and other factors including the rate of inflation.

The main advantages of age-based premiums

Cost

Because age-based premiums usually start off lower than level premiums they are attractive to people who want to get their life insurance in place as soon as possible, but may have budgetary constraints in the early years.

Inflation

Because age-based premiums increase the sum assured, it’s possible for the eventual payout to keep up with inflation. The increase in the cost of living over several years means that a sum that’s fixed at the start of the policy could be worth significantly less in real terms after 20, 30 or 40 years.

Length of policy

You can take out a whole life policy with age-based premiums so that the final payout always increases. You can also choose a term life policy to give the same kind of increasing cover, but set to end at a time when you believe it will no longer be necessary.

Main disadvantages of age-based premiums

Cost

The downside of keeping costs low at the start is that they will rise each year. For example, if an initial premium of £25 a month were to increase by 5% annually then it would be over £60 a month within 20 years.

Uncertainty

Age-based premiums are designed not only to take account of how risk increases with age but also to make sure the insured has enough cover to make up for the erosion of value caused by inflation. However, it’s not an exact science because the forces that act to increase inflation can’t always be predicted. Spikes in the cost of living could mean the policy is under-performing. Also, if your premiums are reviewable, you may not always know how much of an increase to expect.

How do level life insurance premiums work?

Level premiums are set permanently at the same level throughout the life of the policy. The eventual payout also stays the same. Both figures are calculated according to the age of the insured at the time they take out the policy as well as their health and any other risk factors. Insurers are also likely to consider the possible effects of increasing age and declining health over time but won’t adjust the premiums or the sum assured – these issues are built into their initial underwriting.

Main advantages of level premiums

Cost

Level premiums generally start at a higher level than age-based premiums but this is at least partially compensated for over time by the fact that they never increase. Depending on the length of the policy, it could work out cheaper over all.

Consistency

This allows for certainty when you’re budgeting. Unlike policies which calculate your life insurance cost by age, level premiums are an unchanging cost which makes it easier to plan years ahead.

Length of policy

As with age-based premiums, you can find insurers who will offer both whole life and term life policies with level premiums.

Main disadvantages of level premiums

Inflation

Fixing the payout at the start with level premiums means you have no protection against the effects of inflation. A figure you choose today won’t be worth the same in 30 years. The Bank of England has a useful calculator that demonstrates the potential of inflation to erode the value of money.

Higher future expenses

Just as level premiums don’t let you keep pace with inflation, they don’t anticipate the possibility that your dependants may face unforeseeably higher costs in the future, for things like university tuition fees and house prices.

Choosing between the two

Ultimately only you can decide what will work best for you. Both have their pros and cons so you may not find either to be the ideal answer. However, if you take into account the widest range of considerations – including your current circumstances, your expected future earnings and the growing or shrinking needs of your family – you may be able to settle on an acceptable solution.

Who are age-based premiums for?

They’re particularly suitable for younger applicants who may prefer the initial lower cost but are prepared to pay higher premiums as they get older and their income increases.

Who are level premiums for?

These are often favoured by those who prefer predictability and stability in the cost of their protection, without being concerned about matching inflation.

FAQs

There’s nothing to stop you from objecting to a particular increase but whether you’ll be successful depends largely on the terms of your policy. Some insurers may agree to it on rare occasions while others may suggest that you switch to a level term policy. If you do persuade them to waive an increase, bear in mind that it means the amount of your payout will not increase either. If you are unhappy with your insurer’s response you can make a formal complaint, first to them and, if you’re still not satisfied, to the Financial Ombudsman.

Your insurer may be happy to arrange this but you should be aware of any policy terms that affect this, such as fees or penalties. In some cases, your insurer may not allow you to switch an existing policy but will ask you to cancel it and take out a new one on the new terms.

Most insurers will consider a request to extend either kind of policy although it may involve fresh underwriting process to reassess the risk and possibly charges. Some policies are designated as ‘renewable’ from the start which means they can be renewed for fixed periods at pre-set milestones. For example, a 10-year policy that’s coming to an end may be renewable by 1 year at a time for up to a further 10 years.

Yes, it’s common practice to add other forms of cover to a life insurance policy of any kind. Examples include children’s cover and critical illness cover. You’re not obliged to take them out with the same insurer that provides your life insurance cover but it may be cheaper and easier to do so.

It depends entirely on the policy you choose. Level term policies do not, except in rare circumstances, whereas policies with age-based premiums will.

It’s impossible to put a figure on it, because every policy depends on so many variables particular to the individual and the insurer. Some research suggests that for a single healthy 30-year-old with no health issues, level term cover of £200,000 for 25 years could cost as little as £8.

Related resources

Turning Customer Curiosity Into Confidence: Theea's Coverage Calculator

Introducing Theea's Coverage Calculator: the intuitive insurance tool inspired by thousands of customer conversations that turns anxiety into tailored advice and confusion into confident choices.

Meet Your Newest Eleos Perks

We’re expanding our perks with two new additions designed to turn good intentions into healthy habits. Discover everything you can get for free with an Eleos policy.

Income protection for smokers

If you smoke, you may have a tough time getting income protection insurance, but it’s not impossible.

Do doctors need income protection?

A career as a doctor may be a vocation but you still have to earn a living

Do trade union members need income protection?

What financial support will your union give you if illness or injury forces you to stop working?

Getting Britain Working Again?

On 18th March 2025, the Secretary of State for Work and Pensions announced controversial disability benefit reforms